LoanPro Alternative

Get started on the profitable lending business with Appdupe’s innovative LoanPro alternative. The best choice that comes with the latest technology in the market, enabling you to offer safe and secure lending.

Get started on the profitable lending business with Appdupe’s innovative LoanPro alternative. The best choice that comes with the latest technology in the market, enabling you to offer safe and secure lending.

The financial landscape has transformed widely over the past few years. With industries around the world getting digitized, lenders are looking for a more modern, streamlined approach to loan management. The need of the hour is the atomization of key aspects of the lending process along with enabling processes that are scalable, fast, flexible and agile, while being cost-efficient. Appdupe has emerged as the world's leading provider of Loan Management Technology due to its scalable API-based approach and highly customizable software, which can be combined with multiple applications and a superior credit rating mechanism.

Our LoanPro Software alternative supports various sides of the Loan portfolio, from prospecting to closing and tracking. The integrated loan processing system enables the automation of processes for cost reduction and better consumer service for banks and financial institutions. We offer technology-enabled financing systems that boost efficiency and consumer satisfaction over the life of the loan.

According to the US Federal Reserve, personal loans have increased in the last 4 years, from USD 72 billion in 2015 to USD 143 billion in 2019. With a total of 21.1 million exceptional personal loans in the country, 19.1 million customers have an unsecured personal loan. As the lending process is a complex process, it is difficult and time-consuming. The growing demand from financial institutions for automated application processes coupled with effective scanning drives the Loan Servicing Software industry. Increased digitization in the banking sector has further fuelled business expansion. With the introduction of Big Data Analytics and other emerging technology, the Loan Servicing Software sector becomes an opportunistic one.

Loan TypesQuickly generate loan programs, such as term loans, non-revolving loans, liabilities, and pool loans.

Interest MethodsChoose from basic interest, fixed amortization, flexible amortization (beginning), rule 78s, and average daily balance.

AccrualAccrue the first day, or the last day, or both. Start or end of the day. Value year 360, 364, 365, 366, or actual.

Interest RatesSet the standard rate (e.g. Libor, WSJ Prime). Compound based on days, number of periods.Set the minimum interest rate, the post-maturity rate, default interest.

Payment PeriodsPick from days, weekly, biweekly, sub-yearly, 28 days, monthly, bi-monthly, quarterly, semi-annual, annual, maturity, or self-defining.

Automatic Late FeesAutomated late fees and NSF processing – automatic withdrawal on effective dated payments or addition on reversals and NSF.

Payment Application OptionsDefine the payment application waterfall and customer rules to control thresholds and payoffs.

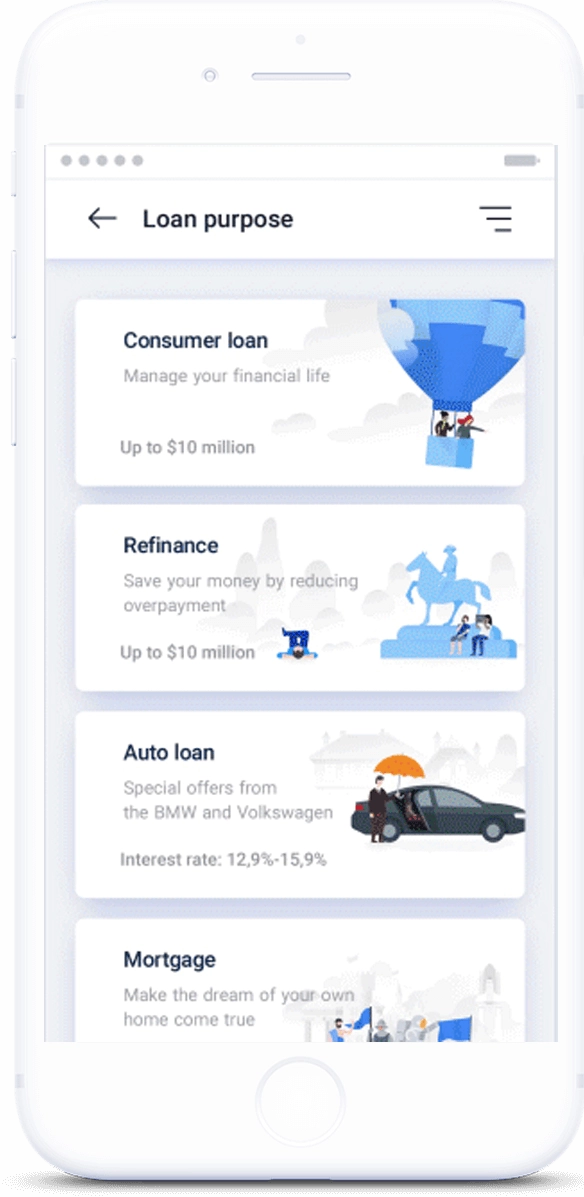

Loan Servicing and Management SystemsAt Appdupe, we specialize in creating custom loan servicing systems, and Loan Management Systems (LMS) for companies, credit unions, investment banks, etc. Such programs provide comprehensive functionality for the origination, delivery, amortization, collection, and disbursement of loans. We also monitor various forms of loans, including family, business, student, mortgage, vehicle, installment, payday, and cash advance.

Loan Origination SystemsWe provide Loan Origination Systems (LOS), such as platforms for online loan applications, underwriting, credit pull, decision support, conditions tracking, and more. We create loan document management applications for upload, querying, data retrieval, records management, and documentation, incorporated with compliance management modules.

Loan Decision Support SoftwareWe design Decision Support Systems (DSS), combined with Background Compliance and Credit Reporting Offices (Experian, TransUnion & Equifax). Such programs include flexible risk management, rule-based engines utilized by third parties such as Data X, Microbilt, Clarity, and DecisionLogic.

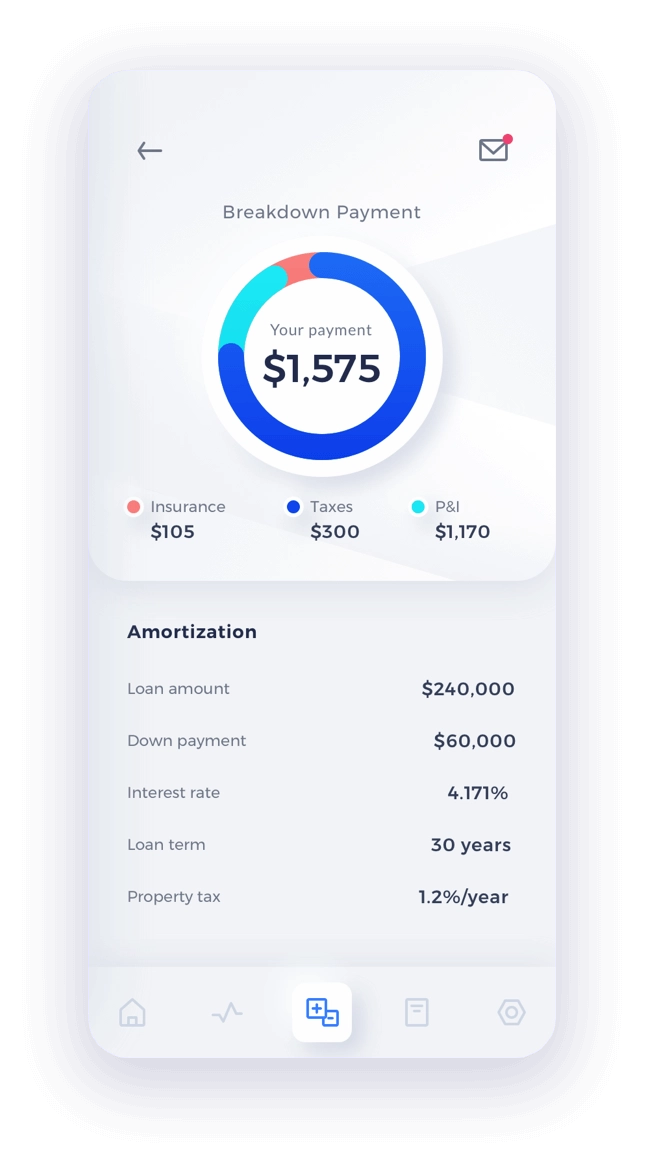

Loan Amortization Calculation SoftwareWe program various loan rates, including fixed, variable, step-rate, credit lines, multi-draw, Adjustable Rate Mortgage (ARM), interest-only mortgage, contract, pledge, and non-revolving. Multiple interest measurements, including simple, compound, periodic, actual days, and Rule 78s, are also supported.

Custom Loan Servicing PortalsAppdupe provides loan procurement database tools, combined with CRM systems, for reliable data collection, queue tracking, and account aggregation. We code self-service consumer portals for database tracking, account and balance browsing, payment collection, and payout estimation. We also develop borrower and creditor dashboards to manage multi-borrower and syndicated loans, co-borrowing.

Loan Settlement Software PlatformsOur specialist programmers set up debt collection and resolution systems that incorporate automatic billing and auto-debit. Both systems allow Automated Clearing House (ACH) and Electronic Funds Transfer ( EFT) transfers, credit cards, bank accounts, online wallets, and other modes of payment. We offer best-in-class loan collection and disbursement management solutions by integrating third-party vendors including BlastPay and AutoPal.

With full internet exposure, one can handle their loans in the workplace or on the go.

Make different user profiles with configurable limitations that enable you to have skilled personnel who could only access whatever they need.

The API helps to integrate your applications with LoanPro Software alternative.

See the real-time analysis of loan purchases as scheduled, as actually happens, and as predicted to happen in the future.

In-built verification tools that help verify all your loan data from email addresses to more serious implications.

Our software allows you to seamlessly store data in the form of backups that can be accessed from anywhere in the globe without the fear of data loss.

The LoanPro alternative is PCI compliant and uses TLS to encrypt access to servers so the security of your data is ensured at all times.

Advanced queries provide quick and reliable access to a wide range of data.

Our powerful reports enable you to quickly analyze and evaluate your data.

The LoanPro alternative is incorporated with the top cash payment service, enabling for 24x7 cash transactions.

LoanPro alternative is tied up with leading card payment providers so that debit and credit cards can be processed manually and automatically.

LoanPro alternative is combined with a number of eCheck processors such that you can draw capital straight from the customer's bank accounts.

This program helps you to deliver mail to your lenders through USPS. Set up the mail to go out automatically, or start it via manual process.

A customer-facing page provides the lenders the ability to make deposits online and access details regarding their loans.

Automatically send customizable emails to customers and prospective consumers.

Automatically deliver text messages to clients to inform them of the cost of loans, to give them deals, and more.

Submit pre-recorded phone calls automatically and be notified with a notification on the outcome of each call.

See easily whether various loans fulfill the conditions that you have developed. It will help you make decisions regarding collections, deals, and more.

Set up loan reminders that help those in the business see the most critical detail regarding every loan.

Automatically receive text, emails, or in-software notifications whenever an incident occurs pertaining to your loans.

A Comprehensive LoanPro Alternative Helps you Complete the Loan Process

We have built solutions that can take care of everything from origination to servicing the loans to overview and collections.

Easy Customization / Integration

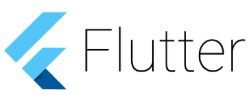

Our platform helps consumers to build new loan applications and conveniently fill out the appropriate forms from a broad variety of devices, including smartphones, tablets, or computers.

Automation / Transparency

Every phase along the way the client is notified of pending documentation and incorporated with the e-signature feature to eliminate manual actions.

Data & Analytics

Deliver deep insights into your user base and grow your business.

Tried and proven ExpertiseWe have been an experienced Fintech software provider for several years and are well versed in security and compliance regulations. We stick to global regulatory principles and guidelines, effectively applying them at all stages, including KYC, AML, GDPR, PCI, and others.

Ready to CollaborateWe pride ourselves in our ability to implement strategies and deliver our solutions quickly and remotely. If further work is required, we provide Development step services and enable all business / tech criteria to ensure a productive outcome of the project.

Highly level of TransparencyWe are dedicated to the idea of transparency and keeping our clients in the loop. Receive 24/7 exposure to effective project management resources to ensure that the project performs on schedule and under budget.

Skilled PersonnelPerform critically relevant sensitive tasks with our team of specialists. Leverage your success with your first-hand knowledge of web and mobile app creation, research, implementation, integration, and cloud computing.

Our LoanPro Software alternative is a multi-feature, user-friendly, all-encompassing loan servicing software. It works great for low, medium, and high-volume lenders. The software is easy to use and will help streamline your lending company’s workflow and task management, to help you maximize profits. Our loan management software contains a multitude of features that will help automate tedious servicing, collecting, and reporting projects so you can focus your time on growing your business.

With the digital revolution, every industry is arming itself with the tools they need to allow on-demand and remote services. Our LoanPro Software alternative gives lenders the ability to cater to a diverse range of customers from around the world with our modern day loan processing abilities.

As an experienced developer in the market, we have an in-house team that can do it all. Apart from development, we offer marketing, business analysis and development, SEO services, and post-launch maintenance and support. All these services are priced at a very affordable price and can be availed as part of a package. Get in touch to learn more!

The exact cost of development is dependent on a lot of factors including the time it takes to develop the product, the extent of features to be included, the complexity of the development process, the personnel involved and a lot more. To get an accurate result of price specifications, get in touch with our team, and we’ll be happy to help you out.

Get your blockchain application development idea validated right away.