Avant Clone – Launch a Next-gen Game-Changing Loan Lending App Like Avant In The Market

Author Lending App Development

Money has become an utmost requirement for any of us as it is the medium of exchange. We require cash for everything we do. These coins and papers decide one’s social position and distinguish or classify people into rich and poor generally. The emergence of money has totally revolutionized the world, as it has become the basic necessity of any activity we indulge in. Man found many ways to make money, and it gave rise to business sectors.

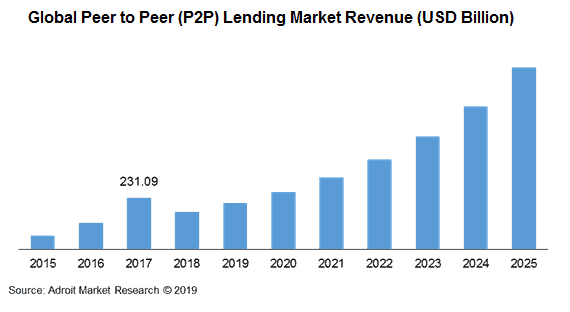

Anything is business nowadays; Lending money has become a tremendously profitable business in today’s world. There used to be times where only banks provided lending financial services, but as time passed, people found it difficult to provide so much collateral and pay such a massive rate of interest. And today, we have so many individual entities providing financial lending services. The global lending market revenue is also spiking out as in this below graph,

Avant – A classic financial lending service platform acquired Zero Financial to become a digital bank

Avant is a private financial lending platform that offers various services related to credit cards and loans. This company came into existence in 2012 and has provided financial lending activities for around 6.5 billion so far. This company mainly operates from Chicago and offers financial services within the United States. It offers loans from $2000 to $35000 with APRS ranging from 9.95% – 35.99%. The loan tenure ranges from 24 months to 60 months. Avant is one of the many successful businesses and has some seriously proven numerical defining its growth.

Avant has served over 1.5 million customers, issued over 400,000 credit cards, and it didn’t stop there. This company is currently focusing on becoming a digital bank, and as a move towards its focus, it has acquired Zero Financials and its subsidiary called Level in order to expand its business operations to become a digital bank.

The working model of Avant like loan lending apps

The working model remains similar for every lending platforms; the steps involved in the process of availing a loan from such platforms are mentioned below,

- Registering

- Filing required details and attachment of e-documents

- Link bank accounts

- Choosing a scheme

- Availing the loan

Registering

The users will have to download the application from their respective app store or visit the company’s official website and register themselves within the portal or app.

Filling required details

Once they register, they will have to log in and enter the required information and attach the proofs that support the details provided by them. It can be a virtual copy that can be uploaded.

Linking bank accounts

The next step would be to link their bank accounts, and the officials will cross-verify the details entered by the users. The loan amount will be credited to the bank accounts if the user is eligible for the loan scheme preferred by them.

Choosing a scheme

The documents will be verified by the officials, and in the meanwhile, the users can select a scheme that will suit their needs. The scheme will contain the loan amount, loan tenure, and interest rates.

Availing the loan

If the verification process is successful and the user is eligible for the scheme they have preferred, then the loan amount can be availed by the user, and it will be credited to their bank accounts.

GOT AN IDEA TO STARTUP A LOAN LENDING APP? LET’S DISCUSS!

Benefits of an app like Avant

There are so many benefits of such loan lending platforms, and some of them are discussed below,

- Simple procedure

The users will just have to fill up the loan forms within the app, and the loan will be approved instantaneously after verification.

- Security

Every transaction made through this platform is highly encrypted and secured; the users can create a strong password for their account and keep it safe without sharing it with anyone at all.

- Loan options

As it is all virtual, the users can browse through various loan options and choose their preferences, and it will be validated according to their eligibility.

- Less paperwork

Since everything is done virtually, there is no involvement of physical paperwork. This makes the process easier and less time-consuming.

- Accountability

All lenders who have their apps are recognized and earn the trust of the borrowers. If you are skeptical about borrowing money from a company outside, you can always read the reviews and check the ratings of these apps before borrowing money from them.

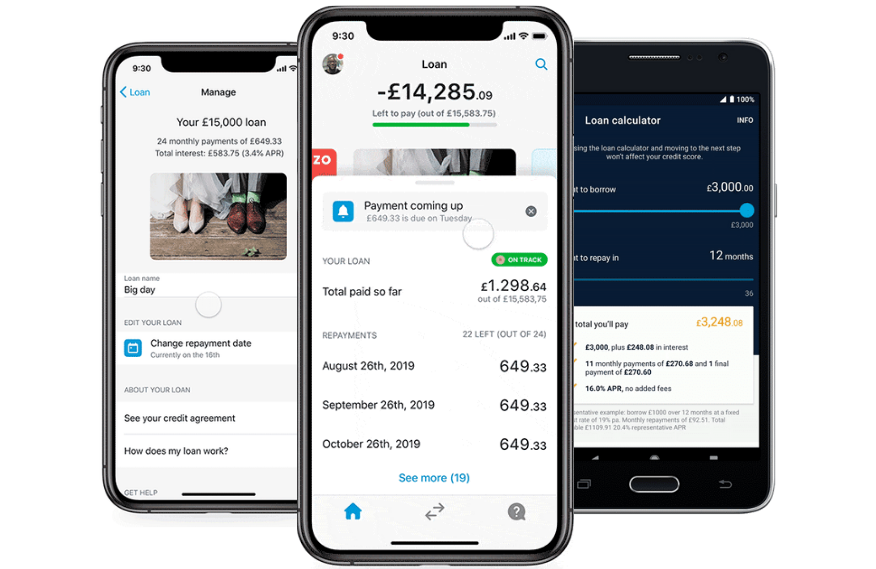

Features of a lending app like Avant

Apps like Avant are well known for the features it offers. The features of the user panel and the admin panel are mentioned below,

User Panel Features

- Registration/Login with social or email id

- Apply for Loans

- Set payback period

- EMI, Interest calculation

- Payment schedule and billing

- View EMIs paid/unpaid

- Withdraw money

- Connect bank accounts

- Transfer money to a bank account

- Discount and offers on credit cards usage

- Reward points

- Variety loans

- Online chat and call support

- Notification

Admin Panel Features

- Login via email ID

- 2 Factor authentication

- Manage rewards

- Manage Discount and offers

- Manage Profile approval

- Manage customer KYC approval

- Manage customer credit limits and requests

- Manage Users

- CMS Integration

- Manage Bank Partner Management

- Manage Profile

- Loan Management

Avant Clone: How to develop an app like Avant?

The process of developing an app involves various stages, starting with planning till the launch of the application.

The steps or stages of app development is discussed below,

- Developing a Strategy – This would be the first step in the development process, defining strategic goals that would evolve your business idea into an application.

- Analyzing and Planning – The next step would be to identify your business requirements and prepare a planning document regarding the work process.

- UI/UX design – Once you have planned the process, the next step would be ensuring a seamless and best user experience with an exclusive design.

- App development – The backend, API integration, and mobile app development happens at this stage.

- Testing – This is where the quality of the application will be accessed, and initial bugs and glitches will be fixed if there are any.

- Deployment of the app – When the app clears the testing and quality analysis stage, it is all set to be launched in various platforms like Android and iOS app markets.

The above mentioned are the stages of developing an app from scratch; there is one more game-changing alternative called Clone solutions. These are pre-built, ready-to-deploy applications that can be further customized and modified according to the needs of the business. This method is relatively cheaper than the method of building an app from scratch, and it is also time-saving and worth every money invested on this.

If you are wondering where to avail of such services, We are right here. We are called The Appdupe, an app development company. Reach out to us to create a loan lending app like Avant, and we are the best in the market. Our team awaits to serve your needs. So connect with us ASAP.

Ending Thoughts

The financial lending services business is one of the emerging markets at present, be an early bird to enter into this market segment and build your own business empire in the market. This segment has all the possibilities of becoming a profitable business sector in the coming future. Be wise and start your lending app with us.

Want to Create a Lending App Like Avant & Fast forward to become a Digital Bank?

Marketing is my soul mate and writing is my side kick. Using my writing skills to share the knowledge of app development and upcoming technologies.