Team Of Crypto Developers, Marketers & Designers

White-label DeFi Platform Solutions

Years Of Seasoning In The Blockchain Vertical

Successfully Delivered Projects

DeFi Platforms Developed

It is quite challenging to comprehend the shockwave induced by the advent of DeFi into the cryptosphere, with the former terraforming the entire financial outreach of the blockchain space. Why so? DeFi offers an exciting alternative to the stack of inefficiencies allied with conventional financial institutions by facilitating the entire spectrum of fiscal operations in the vicinity of blockchain technology. Massive profitability is all that awaits for entrepreneurs willing to plunge into this remunerative silo.

At Appdupe, we proffer you the Aave clone - an avant-garde DeFi lending protocol that can be comprehensively customized as per your requirements. With Appdupe’s technological backing, nothing can stop you from seizing DeFi glory in the shortest possible time. Connect with us to know more!

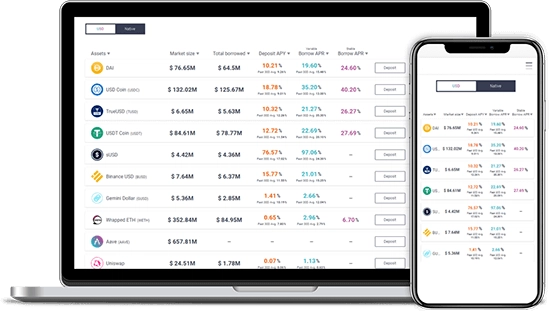

The Aave clone script is a completely decentralized money market protocol that empowers users to lend and borrow cryptocurrency assets in a seamless manner. Coupled with the infusion of stable and diverse interest rates, the open-source Aave clone delivers terrific crypto finance performance. Users can effortlessly earn interest on their crypto assets’ deposits and borrowing. Not to mention its irresistible technological competence!

DeFi lending and borrowing has set the blockchain base on fire for all the right reasons. The market desirability for a non-custodial protocol like our Aave clone is scaling unprecedented peaks, thanks to the exertion of asserting customer value and convenience. With the total value locked in the compound expected to exceed the monumental $1 billion mark, the probability of hitting astonishing rates of profits is assured. All that is needed now is a leading-edge DeFi lending/borrowing platform like our Aave clone!

The Aave DeFi platform employs its native tokens named LEND, which are stated to be swapped for the governance token AAVE. The AAVE governance token will create a financial services ecosystem in a future-proof framework with pressing emphasis on viability and safety. LEND leverages Ethereum’s ERC 20 token protocol and is used to avail of discount and price cuts on the transaction fee. Additionally, the LEND investors are pampered with a share of the Aave platform’s transaction fee in order to secure the fiscal health of the platform. Like other native tokens, LEND accredits users with voting rights on governance issues as part of Aave Improvement Proposals (AIP). The conversion rate for LEND against the governance token is affixed at a ratio of 100:1 in order to clock the target numbers.

If there is a feature that will catapult the popularity and global adoption of the Aave clone, it is its ability to levy flash loans - unsecured loans where a user can borrow an asset as extended as the borrowed amount and an additional fee is repaid before the transaction ends. Monitored and actuated by automated smart contracts, the flash loans open the floodgates of a diverse range of opportunities within the crypto-finance nexus.

The basic functionality is that a loan is programmed, where a user requests a certain amount of tokens of an asset supported by the platform in return for the payment of that loan within the same operation carried out by the smart contract programmed by the user. In other words, the execution of the smart contracts is taken as the intermediate time, where we can request the loan and pay it. At the exact point of smart contracts’ execution, one can schedule extra transactions and at the end, the borrowed money must be repaid with the interest without fail.

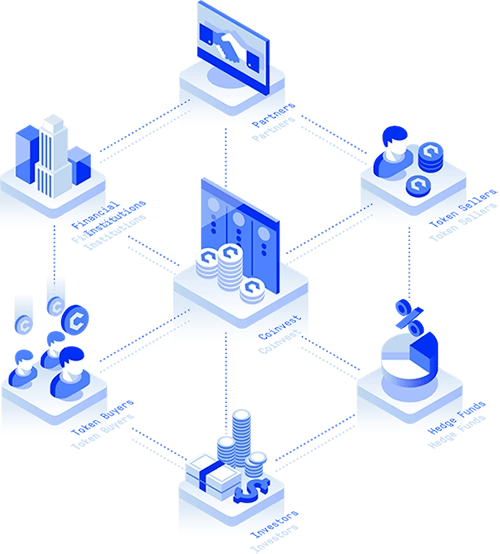

The core functions of the DeFi lending protocol like Aave are channelized through its robust architecture and an efficacious work system. Being entirely decentralized, the lingering disruptions like the presence of third-parties in the lending and borrowing process is competently banished. Take a peek at a word sketch on how this vital process plays into the field:

LendingAny registered user can lend their cryptocurrency assets to anyone, transcending the constraints of geographical boundaries and nationalities. Terrific interest amount based on the magnitude of the lending index is proffered to the user besides earning additional DeFi tokens.

BorrowingAffixing crypto assets as collateral, users can borrow digital funds in a hassle-free manner. The problem of the collateral being higher than the sum borrowed is resolved by the introduction of stablecoins that dodge the volatility of the crypto possessions. If the user wasn’t able to repay the borrowed amount, the attested collateral is subjected to instant liquidation.

In a nutshell, the Aave clone script is a thoroughly secured, non-custodial decentralized finance protocol that empowers users to participate in financial operations as borrowers/ depositors. A user wishing to lend can deposit their funds into the liquidity pools, and earn consistent interests in accordance with the existing market conditions. The amount of interest paid to the borrower is directly proportional to the borrowing rate and utilization rate.

All that a borrower needs to draw digital funds from the liquidity pools is to nail down on collateral. This way, borrowing users can pawn an amount in an undercollateralized or overcollateralized manner. Every liquidity pool sets crypto assets aside as ‘manage’, in order to quench the misnomers of volatility. This assures that the lenders can withdraw their deposited funds and exit the protocol as per their convenience.

DeFi protocol development like Aave eliminates the need for a third party, as users can interact with each other and facilitate the lending-borrowing activities through the ingenuity of smart contracts deployed on the Ethereum network. It is imperative that the borrower must maintain the collateralization ratio i.e. the holded collateral must be greater than the amount borrowed. Failing to do so will result in access to other users in a quest to liquidate the collateral security. Interest-bearing tokens are showered to the users, irrespective of their financial roles a.k.a lenders/ borrowers.

The process of liquidation initiates when the borrower’s collateral value declines notably that it no longer completely covers the loan amount. This can be instigated when the value of the crypto collateral falls or when the value of the borrowed debt amount increases steeply, leaving the affixed collateral inadequate. Based on the type of collateral, various liquidation penalties can be inflicted. This can be avoided by offering higher collateral, well-higher than the previously offered quantity.

Innovation takes its roots from necessity, and nothing can be more staggering than solving the stack of hardships associated with the conventional lending/ borrowing process. Do you know someone who has stormed a bank premises, and walk out with a loan in a couple of hours? No, you don’t! From choosing the right bank, filling the never-ending forms manually, and ensuring your credit score matches the minimum criteria, commotion and chaos fill the scene.

The imminent alternative seems to be private lending and borrowing, but it's not. The presence of unverified third-parties severely deter the credibility of the private font, and the voice for a trustable, secure, and seamless platform was finally answered by the arrival of decentralized financial protocols, much like our Aave clone.

Margin Trading The DeFi outreach entitles users to purchase any asset and trade them straight away in any exchange for other cryptocurrency assets. This way, streamlined liquidation is ensured

Durable Investment RewardsLoyal investors who keep their crypto assets idle are offered an arrangement to lend and earn additional cryptos from interest on top of a HODL strategy and capital appreciation.

CEX/ DEX ArbitrageUsers who are able to access credits in fiat currencies can borrow them for comparatively lower rates and sell them on CEX for respective crypto assets, which can be encashed by lending on DEX, earning arbitrage fees on the process.

Flash LoansWhat if the users can get their hands on instant loans without clamping any crypto collateral? Aave clone’s flash loan issuing functionality makes it a reality!

Zero-Tax LiquidityUsers can avoid nagging taxes by obtaining crypto loans against their collateral to gain fiat currency. This way, a remarkable magnitude of liquidity can be actuated without the clutches of taxation.

Appdupe’s crypto protocol experts converge their best to enrich your solution with unassailability.

Aimed to resolve governance issues, the Aave clone script is embedded with its own governance token. Mounted over the Ethereum mainnet, it supports seamless staking capabilities. Additionally, certain users are entitled to stake/ delegate tokens, which can be withdrawn as per their needs and requirements. This set of users guide their delegated group on governance issues. Alternatively, reports allied with governance can be signed from cold storage to banish away the need to transfer tokens from cold wallets to hot wallets without a hitch.

Lender Account Creation Through a simplified registration field, users can seamlessly create the lender account after verifying their KYC/ AML information.

Upload Essential Details The lender can update their personal information and affix the type of investment they are interested in.

Lender Waiting For Loan Request The lender's account remains idle until they stumble upon a prospective borrower.

Borrower Account CreationA slew of KYC/ AML verifications leads to creating a borrower account and updating the necessary personal information.

Borrower Sends Loan RequestBorrowing users can create and send loan requests to the global network of available lenders and mention the fixed/ collateral amount.

Lender-Borrower Match The Aave clone script automatically matches and assigns the borrower's loan request to a compatible lender instantly.

Lender - Borrower Interaction The lender catches up with the borrower, dictates the loan terms, and upon complete agreement, the loan will be approved.

Smart Contract Definition A dedicated smart contract affixes prominent information like interest rate, total token value, loan tenure, and market standards.

Borrower Receives Loan Once the smart contract locks the interest rate, the lender sends the prefixed amount of tokens to the borrower in a jiffy.

Repayment Of Loan The borrower is expected to repay the loan amount, along with the interest amount, within a mutually agreed time frame. If not, the crypto collateral is liquidated, and an instant reimbursement is sent to the lender.

Appdupe is the name that every entrepreneur wishes to collaborate with for the purpose of DeFi lending & borrowing development, given our technical prowess and technological acumen. Coming up with avant-garde decentralized P2P lending/ borrowing solutions is our passion, so is our emphasis on accountability and transparency. Loaded with a sprawling team of block geeks, who have swum around the crypto wave since its inception, we ideate, create, design, develop, and deploy premium DeFi iterations across industry verticals.

A unified platform for every crypto-financial endeavors

Margin Trading

Flash Loans

Arbitrage Trading

Non-Taxable Liquidity

A plethora of Ethereum-based assets that include but not limited to Basic Attention Token (BAT), Dai (DAI), Kyber Network (KNC), Ethereum (ETH), Aave (LEND), ChainLink (LINK), Decentraland (MANA), Augur (REP), Maker (MKR), USD Coin (USDC), Synthetic (SNX), TrueUSD (TUSD), Tether (USDT), Ren Protocol (REN). Uniswap (UNI), Synthetix USD (SUSD), Ox (ZEX), and Wrapped BTC (WBTC) are supported seamlessly by our Aave clone.

Get your blockchain application development idea validated right away.